Making- Money With Naked Puts Beginners Guide

I'm not an investment adviser. Don't take my advice. Do your own research and seek the advice of a professional. I'm not an expert. What I'm about to share with you is what I have learned trading in options and shouldn't be taken as the gospel truth until you have researched option trading for yourself. I'm a moron and I seek safe harbor.

One of my favorite strategies is selling put options. Investopedia defines a put option as:

An option contract giving the owner the right, but not the obligation, to sell a specified amount of an underlying security at a specified price within a specified time. This is the opposite of a call option, which gives the holder the right to buy shares.

http://www.investopedia.com/terms/p/putoption.asp#axzz2Movc0Q9o

My more layman's term definition:

A put option gives the holder the right to force the person selling the put option to purchase the underlying stock for a predetermined price for a specified amount of time.

Here is how it works. When I sell a put option, I am basically writing an insurance policy for a stock. The stockholder that buys the put option I am selling wants insurance that will limit the loss on the underlying stock should the price fall.

Consider this scenario. Bob Stockholder buy's 1,000 shares of GE stock at $15. 9 months later, GE is trading for $23 a share. For whatever reason, Bob doesn't want to sell the stock and take his profit right now, but he's worried that the stock could fall and he could lose his gain.

Bob can buy a put option that will insure Bob's 1,000 shares of GE stock should the price fall. That's where I come in. Bob wants to "buy insurance" / put option on GE and I'm willing to collect a premium and "sell him the insurance" / put option.

Bob Stockholder can choose from three main variables when purchasing his option. Those variables are:

strike price, expiration date, and number of contracts.

Strike Price

If Bob wants to insure his shares at $23 a share, then that will obviously cost Bob a higher premium than if he wanted to insure them for $20 a share. Why? Because the "more insurance" Bob wants, it might lower his risk, but it raises the risk of the person insuring the stock.

It is the same principle as home or car insurance. You'd obviously pay more to insure your home at $200K than you would if you wanted a policy for $150K. The value of Bob's insurance is known as the strike price. Bob can choose from a wide range of strike prices when buying his put option.

Expiration Date

Bob can also choose what month he wants his put option to expire. Clearly, the longer the time period Bob wants to insure his stock, the more the option premium is going to cost him.

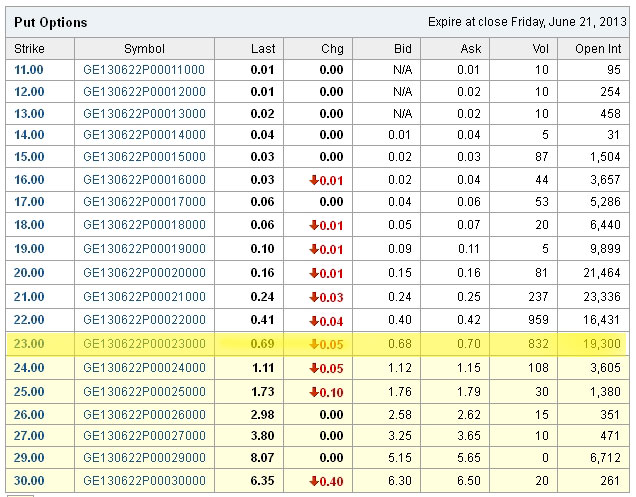

When you are looking at a chart of available strike prices and terms, most charts will only list the month the option expires. With the exception of "special options", most options expire the third Friday of the designated month. For instance, if I sell a put option and the quote charts have it listed as August 2013, the actual time the option will expire is August 16, 2013 at the close of the stock market.

Number of Contracts

When dealing with options, a contract represents 100 shares. If Bob buys 10 put contracts, he's buying insurance on 1000 shares. 10 contracts x 100 shares per contract = 1000 shares

Selling put options sounds risky doesn't it? Well if you play it right, it isn't.

I only write put options on stocks I want to own or don't mind owning. If you follow my strategy, then by writing put options you are going to be paid for not buying a stock you want to own or you are going to be paid to purchase it at a price lower than it is trading for today.

One of the stocks that has made me the most money with put options is General Electric. GE closed at $23.67 today. If I think GE is a good price at $23.67, here are my options.

I could buy 1,000 shares of GE today for $23,670 not counting commission. I'll make or lose $10.00 every time the price moves by 1 cent. Why would I take this approach versus the alternative unless I have some psychic knowledge that GE stock is going through the roof in the near future. (I don't. Only insiders have that knowledge and it's illegal for them to profit from it.)

In my opinion, here is the better choice.

The $23 June 2013 Put Option for General Electric closed today at 69 cents per share. (Chart Below) I could have sold/written 10 June contracts, (Each contract represents 100 shares, so 10 contracts represents 1,000 shares.) for the General Electric $23 put option and collected $690 instantly for doing so. (1000 shares x Premium of 69 Cents a Share = $690)

How do I profit from put options and what are my risks?

If I would have written this option today, I would have immediately collected $690 for doing so. The June 2013 option expires on the third Friday in June. Anytime between now and then, the holder of the option can require me to purchase 1,000 shares of GE stock at $23 a share. As long as the stock stays above $23 a share, that will never happen! No one is going to make you buy a stock cheaper than they can sell it for in the open market.

So if the stock stays above $23 a share, it will expire worthless on June 21, 2013 and I'll keep the $690 premium. If the stock happens to fall below $23 a share, I'll still keep the premium, but I will be forced to buy the stock no matter how low it is trading.

Let's say I wrote this option today and the stock falls to $22 next week. The option holder could choose to exercise the option right away or wait closer to the expiration date. For our example, let's say they exercise the option immediately.

I would pay $23,000 for 1,000 shares of GE stock and I'd keep the $690 premium making my actual cost $22.31 per share. This is $1.36 per share less than I could have bought the stock for when I wrote the option. Provided you follow my rule of thumb and only write put options on stocks you want to own, in my opinion, this is the best method for profiting from those stocks.

I generally make 2 - 3 trades a month. Subscribe to my email list at the top right hand of the page to see what I'm trading and how I'm doing. Good luck with your trading!

More great information:

http://www.investopedia.com/articles/optioninvestor/02/030102.asp#axzz2Movc0Q9o

Leave a Reply